Defense Industry – Business of protecting the nation

- Team SocInvest

- Jun 29, 2022

- 27 min read

Updated: Jan 13, 2023

Part 1: Industry Analysis

“Freedom isn’t free”

India became free in 1947 but has hostile neighbors like China and Pakistan with border disputes. India and Pakistan have fought four wars – 1948, 1965, 1971, and 1999/2000 along with continuous terrorism in Kashmir. India and China fought in 1962. So, the defense industry is of paramount importance to India.

A strong treasury supports a strong army—so advised the 4th BCE Indian exposition on statecraft, Arthashastra, by strategist Kautilya. What it means is that a strong and growing economy leads to a healthy collection of revenues for the government, which it can then spend on a wide range of activities including defense and security. India’s growth since 1990s has created space for strong armed forces and other defense infrastructure.

India has one of the world's largest military forces with a strength of over 14 lakh active members. The total budget sanctioned for the Indian military in FY23 is INR 5.3 lakh crore (~USD 71 billion) or an increase of ~10%. It has the third-largest annual defense budget behind the USA (USD 800 billion in 2021) and China (USD 293 billion in 2021). Over the next 5-7 years, the Government of India plans to spend USD 130 billion for fleet modernization across all armed services. In line with the self-reliant India initiative, the share of domestic capital procurement, which was earmarked at 64% in FY22 has been enhanced to 68% of the capital outlay of the Defense Services for FY23.

The split of the FY23 defense budget is:

Expenditure- USD 49 billion

Pay & Allowance of personnel – USD 20 billion

Pension – USD 16 billion

Non-salary or pension expenses – USD 13 billion

Capital outlay – USD 22 billion

Airforce weapon purchases – USD 7.4 billion; Indian Air Force will spend most of the money to cover existing commitments for French Rafale fighters, Russian S-400 air defense systems, Apache and Chinook helicopters, and Israeli medium-range surface-to-air missile systems

Navy weapon purchases – USD 6.4 billion; Navy will use its funds to pay for one aircraft carrier, destroyers, stealth frigates, and multirole helicopters

Army weapon purchases – USD 4.3 billion; Army will use its funds to pay for T-90 and Arjun MK1A battle tanks, BMP-2/2K infantry combat vehicles, Dhanush artillery guns, Akash air defense missiles, Konkurs-M and Milan-2T anti-tank guided missiles, and multiple types of ammunition

Others – USD 3.6 billion

The Government of India has liberalized foreign investments FDI in Defense Sector which has been enhanced up to 74% through the Automatic Route and 100% by Approval Route. The Government has also announced 2 dedicated Defense Industrial Corridors in the States of Tamil Nadu and Uttar Pradesh to act as clusters of defense manufacturing that leverage existing infrastructure, and human capital.

Key trends in the defense manufacturing sector are:

Modern warfare

Pension costs ~25% of the defense budget in addition to the high personnel costs to maintain a large army. Modern warfare puts a greater emphasis on superiority in areas such as the air, space, and cyberspace – reducing the importance of the ground force. So, it doesn’t make sense to continue with similar strength of the army especially when a nuclear arsenal is a deterrent for large man-to-man combat. Branches such as the navy, air force, and missile units can now play a bigger role in the event of conflict by fighting enemy forces beyond borders. So, to create space for higher spending on modern warfare, the Government of India needs to reduce the spending on personnel costs including pension and hence they have introduced Agnipath/Agniveer policy.

Domestic procurement

With the supply chains disrupted due to Covid-19 and the possibility of geopolitical pressures due to India’s external affairs policies, the aim is to decrease import dependence. The Government of India has formulated the Defense Production and Export Promotion Policy (DPEPP), 2020, which provides thrust to India’s defense production capabilities and exports with a measurable target for defense manufacturing. This Policy aims toward an annual turnover of INR 1,75,000 cr in local defense manufacturing by 2025, which implies a 15% CAGR over FY20-FY25. The policy is looking to double the domestic procurement to INR 140,000 cr by FY25, from INR 70,000 cr in FY20.

GOI is also pushing to develop the domestic defense eco-system through initiatives such as ‘Make in India’ and ‘Atmanirbhar Bharat’ programs presenting opportunities for domestic suppliers. Government has put a ban on the import of ~300 defense equipment and items to boost indigenization.

Exports

India marked a rare milestone in January 2022, securing a USD 375 million order from the Philippines to supply three coastal defense batteries of BrahMos supersonic cruise missiles, along with training and support.

The BrahMos sale is seen as an Indian success: It is New Delhi’s first major military export in years, with countries such as Vietnam and Indonesia also expressing an interest in the missiles.

The missile deal also reflects India’s impressive trajectory in the last five years. In 2017, the annual value of all defense exports was less than USD 300 million, according to Indian Ministry of Defense figures. By 2020, India was among the top 25 global arms exporters for the first time, according to data from the Stockholm International Peace Research Institute. More recent government figures show that India quadrupled the value of its exports between FY16 and FY21, from around USD 275 million to USD 1.13 billion. The vision of the government is to achieve exports of USD 5 billion in Aerospace and Defense goods and services by 2025.

Road Ahead

The Indian government is focusing on innovative solutions to empower the country’s defense and security via ‘Innovations for Defence Excellence (iDEX)’, which has provided a platform for start-ups to connect to the defense establishments and develop new technologies/products in the next five years (2021-2026).

Working through partner incubators, iDEX will be able to attract the start-up community to participate in the Defense India Start-up Challenge (DISC) program.

The Defense Ministry has set a target of 70% self-reliance in weaponry by 2027, creating huge prospects for industry players. It introduced Green Channel Status Policy (GCS) to promote and encourage private sector investments in defense production to promote the role of the private sector in defense production.

One glaring gap in Indian defense is the lack of focus on cyber warfare – the US is expected to spend USD 10 billion on cybersecurity in 2022. India needs to increase its budgetary allocation to this segment.

[End of Part 1]

Part 2: Bharat Dynamics (Missile giant)

Company Name – Bharat Dynamics Ltd (BDL)

Current Share Price – INR 728 (June 24, 2022)

Market Cap – INR 13,344 cr

A. What is interesting about the stock?

India’s defeat by China in the 1962 border war, probably more than any other war, galvanized its leadership to build indigenous missile and “threshold” nuclear weapons capabilities as a credible deterrent against attacks by China, and to attain military superiority over Pakistan. Thus in 1978 started a frantic search to identify a site for the establishment of instrumented missile testing range facility, the only suitable site was found at the Balasore coast of Odisha. A decisive shift in missile development plans occurred in 1983 when the Indian government launched the ambitious Integrated Guided Missile Development Program (IGMDP). The program involved the development of a family of strategic and tactical guided missiles. The mandate was to develop 5 different missiles – Agni, Prithivi, Akash, Nag & Trishul. Agni is the first story that made India an innovative country as far as missile technology is concerned; the Defence Research & Development Organization (DRDO) developed it under Dr. APJ Abdul Kalam’s leadership. The success surprised many developed nations and invited their wrath too. India described the Agni at that stage as a “technology demonstrator”.

However, India needed anti-tank missiles even before the development of its indigenous multi-use missile programs. This gave birth to one such Indian defense giant – Bharat Dynamics Limited (BDL) in 1970. It started its journey with just single product selling to a single customer in a hired building and has now grown as a multi-product, multi-customer & multi-location enterprise. Starting from an Anti-Tank Guided Missile (ATGM) manufacturing, company has forayed into the fields of Surface-to-Air Missile Weapon Systems, Air-to-Air Missile weapon Systems, underwater weapon systems, and associated equipment and also refurbishment of missiles. It is the sole manufacturer of Missiles, Torpedoes, Counter-Measures Devices, and Weapon System integrator for the Armed Forces. It has currently a very strong product portfolio with 3 manufacturing facilities in Hyderabad, Vishakapatnam & Bhanur. It is associated with DRDO as Development Partner as well as a Production agency for various programs. It has Transfer of Technology (ToT) Agreements with major foreign OEMs; they are exploring new avenues with leading Foreign OEMs for the production of new Missile weapon systems in India. It has designed and developed unguided bombs for dropping from drones as per the requirement of the Military College of Electronics and Mechanical Engineering (MCEME), Secunderabad.

BDL currently has an order book of INR 13,000 cr (~4.5x of FY22 revenue) with another INR 8,000 cr orders in pipeline. Exports are expected to be a key avenue of growth for BDL in the future; it has orders of INR 349 cr to export Light Weight Torpedoes & Counter Measures Dispensing System (CMDS) to friendly foreign countries. A defense export strategy has been formulated with a view to facilitating Defense Public Sector Undertaking (DPSUs) and private players in exploring business opportunities overseas. BDL has recently entered into MOUs with DRDO, BHEL, Tawazun Holding Company LLC, UAE to kick start new projects and businesses.

Key Strengths.

Strong moat – the monopolistic nature of this business, it is a mini-ratna company poised to become a maharatna in a few years. Strong order book & products under pipeline demonstrates this along with the support of government & armed forces.

Make in India push - Indian armed forces require severe up-gradation of its infrastructure & weapons systems. BDL is the only company that is allowed to forge partnerships/MOUs with various equipment manufacturers across the globe, indigenize the products & manufacture at scale. This privilege is unseen in any sector in India.

BDL has commenced massive indigenization of components & sub-assemblies of various programs that were being imported by the company. This is expected to save INR 930 cr for the country.

Key Weaknesses

BDL does not have high-tech electronics capabilities. Hence, it will face difficulties in competing with private players in emerging markets. It also has a long road ahead in terms of imbibing manufacturing automation, robotics operated workshops, Industry 4.0 solutions, and IT products.

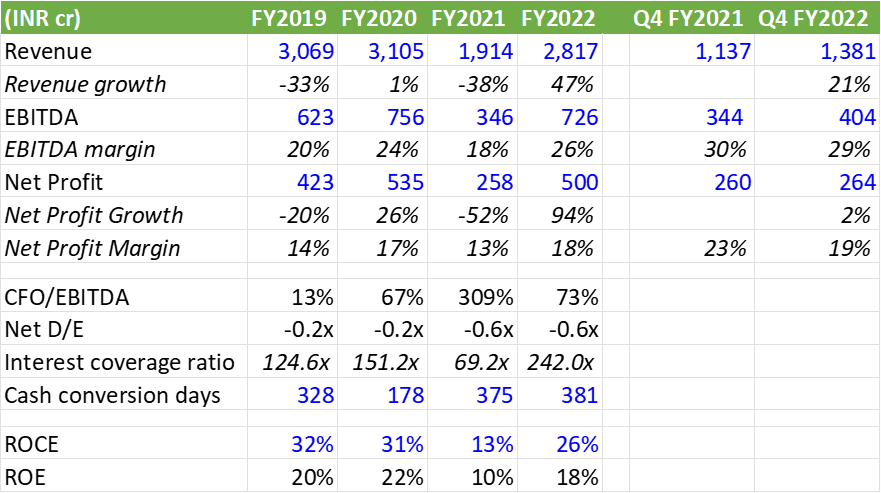

B. Key Historical Financials

Company revenue hasn’t grown since FY19 – fallen significantly in FY21 but recovered in FY22

EBITDA margin has expanded in FY22 to 26% vs 18% in FY21

Cash flow convertibility (CFO/EBITDA) was very good in FY21 when the trade receivables fell significantly, and the payables got stretched. It has normalized in FY22

With the business turning around in FY22, the return ratios (ROCE/ROE) are recovered in FY22 to 26% and 18%

C. What is my view on company valuation?

Bharat Dynamics Ltd has given almost 100% returns in the past one-year period. Company trades at a TTM P/E of 25x (vs 5 year average P/E ratio of 14x) and ROCE of 26%

BDL has hugely improved metrics in FY22 compared to FY21. The question to ponder is whether BDL can maintain these growth rates and keep performing without any hiccups in the long term. The historical track record is not impressive.

BDL is overvalued and hence investors looking to invest for the long-term can evaluate it after significant correction.

D. What are the risks to the investment analysis?

Risks to the analysis are:

Highly dependent on one single customer, the Indian Armed Forces. A decline or reprioritization of Indian defense budget, reduction of their orders, termination of contracts or failure to succeed in tendering projects can have an adverse impact on company’s business.

The company is subject to a number of procurement rules and regulations laid down by Ministry of Defence. The company’s business could be adversely impacted due to sudden and unforeseen change in applicable rules.

[End of Part 2]

Part 3: Hindustan Aeronautics (Powered by Tejas)

Company Name – Hindustan Aeronautics Ltd (HAL)

Current Share Price – INR 1,797 (June 16, 2022)

Market Cap – INR 60,093 cr

A. What is interesting about the stock?

Hindustan Aeronautics Ltd is a Bengaluru-based Defense Public Sector Undertaking that designs, develops, produces, repairs, overhauls, upgrades, and supports a wide range of products, including planes, helicopters, aero-engines, avionics, and aerospace structures. HAL operates 20 production divisions, 10 research and development centers, and one facility management division around the country. It has developed 17 types of aircraft in-house and 14 types under license so far. The Tejas Light Combat Aircraft, the Dornier Do-228 Light Transport Aircraft, the Dhruv Advanced Light Helicopter, the Light Combat Helicopter (LCH), and the Light Utility Helicopter (LUH), as well as associated engines, avionics, and accessories, are all manufactured by HAL. HAL now provides repair and overhaul for 12 different aircraft/helicopters and 14 different engine types. HAL's business has also expanded to include aerospace structures and industrial, and marine gas turbines.

The Hindustan Aeronautics (HAL) and Larsen & Toubro Ltd (L&T) partnership have been chosen as the first bidder for the Indian Space Research Organization's (ISRO) Polar Space Launch Vehicles (PSLVs). This is a crucial step ahead in the transition of PSLV-XL production outside of the Indian Space Research Organisation.

The order book remains strong, supported by the order for 83 Light Combat Aircraft (LCA) with a total value aggregating to INR 36,500 cr received in Q4FY2021, resulting in a closing order book position of ~INR 82,000 cr as of March 31, 2022. India is actively scouting for the export potential for the indigenous LCA Tejas at a vanilla price of just INR 309 cr per aircraft, as countries from Southeast Asia and the Middle East have evinced interest.

The construction of the LCH by HAL will provide the Atmanirbhar Bharat plan with a boost and raise the country's defense output and defense industry's grade. To meet the Make in India policy's goal of USD 5 billion in defense exports by 2025, HAL plans to establish logistic hubs in Indonesia, Malaysia, Sri Lanka, and Vietnam, with a focus on the Southeast Asian, West Asian, and North African markets. It would not only help promote HAL products but also operate as a service center for Soviet/Russian-made equipment.

In addition, the Company has partnered with Israel Aerospace Industries in India to convert civil (passenger) planes into multi-mission tanker transport planes (MMTT). Conversions from passenger to cargo aircraft and MMTT conversions are also part of the partnership's ambit. The MMTT conversion industry has been highlighted as one of HAL's primary diversification areas.

Company operations have not been impacted by the Russia-Ukraine as it had maintained an inventory of the Russian spare parts.

Key Strengths

As of March 2022, the Government of India is HAL's primary stakeholder, with ~75% ownership. Because it is the sole domestic provider of aircraft, helicopters, engines, avionics, and other accessories, the Company is vital to the Indian defense services, including the Indian Army, Indian Airforce, Indian Navy, and Indian Coast Guard.

Due to the high capital intensity and extended development periods for building manufacturing capabilities in the area, the Company faces minimal competition from the private sector. While long-term competition from the private sector is projected to grow, HAL's long-standing partnership with the Indian military and the Defence Research and Development Organization, established production facilities, and skilled labor base will remain critical moats of the business.

The Company had a strong order pipeline, with an outstanding order book of ~INR 82,000 crore (~3.5x of FY21 revenue) at the end of Q4FY22, and the order book is expected to rise by INR 30,000 crore in FY23, owing to platforms for which the Ministry of Defence (MoD) has obtained Acceptance of Necessity (AoN).

In FY2021, HAL received large payments from its customers, which continued in H1FY2022. As a result, the foreign debt was entirely repaid as of September 30, 2021. It also has cash balances of INR 14,350 crore, which are pre-dominantly advances received for the order book.

Key Weaknesses

Sales to the Indian defense forces account for more than 90% of the Company's revenue. These contracts are contingent on the Ministry of Defense receiving budgetary support and distributing the funds to the various Indian Defense Forces wings. The Company has previously faced delays in payments from the Ministry of Defense, resulting in a build-up of receivables and a need for external finance.

As orders have strict execution schedules and predetermined margins, the Company's operations and profitability remain vulnerable to time and cost overruns. Any material cost rises as a result of HAL's delays might impact overall profitability.

Key competitors

Lockheed Martin (F series), Boeing (F series), Dassault Aviation (Rafale), Airbus (Eurofighter), Saab, and Russian manufacturers (Sukhoi) are major competitors of the Company.

On September 1, 2018, R. Madhavan was promoted to the Chairman and Managing Director (CMD) of Hindustan Aeronautics Limited (HAL). He began his career with HAL in July 1982 as a Management Trainee (Technical) and has worked for the organization for almost 39 years.

B. Key Historical Financials

The Company suffered a production loss due to the second wave of Covid-19. Still, the Company met its revenue growth expectations in the second half of the year, owing to improved performance. Hindustan Aeronautics Ltd reported its highest-ever revenue of nearly INR 24,620 crore for the fiscal year ending March 31, 2022, up 8% from the previous fiscal year. HAL claimed it set a new income record with the manufacture of 84 new engines, 44 new helicopters/aircraft, and the refurbishing of 203 aircraft/helicopters and 478 engines. In the coming quarters, further helicopter and LCA (Light-Combat Aircraft) orders are expected. Revenue growth has been 6-8% in the last few years which doesn't look good. A major portion of the revenue jump from LCA is expected in FY24.

EBITDA margin fell in FY22 but the net profit margin expanded significantly due to higher other income, lower interest cost (owing to debt repayment), and lower effective tax rate.

ROCE/ROE has been quite healthy at 30%/29% in FY22.

Cash flow from operations is lumpy as it depends on the project delivery and Indian government finances. With debt completely repaid, Company would be generating high free cash which can be used to provide dividends.

C. What is my view on company valuation?

HAL is currently trading at an EV/EBITDA (TTM) ratio of c. 7.2x and a P/E (TTM) ratio of c. 11.8x.

The stock gained momentum in April-June 2022, with the share price rising from INR 1,400 to INR 1,797.

Government of India owns ~75% of the firm, while Institutions (Domestic and Foreign) control ~21%.

In my view, HAL is a solid and robust business but is currently in the overbought zone with a current P/E ratio of 12x vs a 5-year average P/E ratio of ~10x. HAL has the potential to be a rewarding investment. An increase in interest rates is pulling the market down and could provide an opportunity for investors to add the stock at the right levels.

D. What are the risks to the investment analysis?

Risks to the analysis are:

Increased rivalry from foreign firms due to the planned increase in the FDI limit from 49% to 74%.

Covid-19 particular hazards include economic downturns, reductions in defense spending, supply chain interruptions, vendor failures, legal issues, and so on.

Consumers' choices in defense have evolved from a single provider to more than one provider in each domain, so the share of the wallet gets fragmented.

[End of Part 3]

Part 4: Mazagon Dock Shipbuilders (Naval Defense Play)

Company Name – Mazagon Dock Shipbuilders Ltd (MDSL)

Current Share Price – INR 240 (June 23, 2022)

Market Cap – INR 4,831 cr

A. What is interesting about the stock?

“A good Navy is not a provocation to war. It is the surest guaranty of peace.”

--- President Theodore Roosevelt

Since the man could navigate the seas, he has had an unquenching desire to own them, and the ability to project strength across oceans is a defining feature of any world power. With seas on 3 sides (including an ocean named after it) and a long coastline of 7,500 km, India needs to have a strong naval presence – the Indian Navy and the Coast Guard are the essential forces defending the country.

Visits to the Navy frontline warships at Colaba, Mumbai on their open days have allowed my kids and me to be overwhelmed by the majestic power of these vessels that take on the waves and the stories that they have been part of. And this Company has been at the forefront of this action. Taken over by the Government in 1960, the dockyard has been serving the Indian Navy for the last 6 decades, repairing, modernizing, and building destroyers, missile boats, and submarines. The Company has also fabricated and delivered jackets, main decks of wellhead platforms, process platforms, jack-up rigs, etc. for offshore oil drilling.

Mazagon Dock Shipbuilders Ltd (MDSL), Mumbai, is a leading shipbuilding yard in India. Its history dates back to 1774 when a small dry dock was constructed in Mazagon. Over the years, MDSL has earned a reputation for quality work and established a tradition of skilled and resourceful service to the shipping world, especially the Indian Navy and Coast Guard. It was incorporated as a private limited company in 1934.

After its takeover by the government in 1960, MDSL grew rapidly to become the premier war-shipbuilding yard in India, producing warships for the Navy and offshore structures for Bombay High. It has grown from a single unit, small ship repair company, into a multi-unit and multi-product company, with a significant rise in production, use of modern technology, and sophistication of products.

MDSL is engaged in shipbuilding and ship repairing. The Company operates through two business segments, namely shipbuilding and submarines. The shipbuilding segment builds naval ships and commercial vessels, which include Nilgiri, Corvettes, missile boats, Godavari class frigates, patrol vessels, destroyers, Leander class frigates, trilling suction hopper dredgers, general cargo vessels, offshore supply vessels, special trade passenger cum cargo vessels, 45T Bollard Pull Voithtug and BOP vessels. The submarine segment builds submarines, which include INS Shalki, INS Shankul, and Scorpene submarines. From the time it was taken over by the government of India in 1960, MDL has built 796 vessels, including 25 captive warships and 5 conventional submarines.

MDSL (along with its associate company, Goa Shipyard Limited (47.2% shareholding)) has an order book of INR 46,000 crores (around 8x of FY22 revenue) as of March 31, 2022, predominantly from the Indian Navy. This includes 3 destroyers and 4 frigates. Two more submarines are also under construction. In addition, MSDL is carrying out medium refit and life certification of submarine INS Shishukumar.

The Indian Navy currently has a capacity of 137 fleets and is aiming to have a 200-ship fleet by 2027 as per a maritime capability perspective plan. So, MDSL is well-positioned to win new orders over the next 10 years out of an INR 2.1 lakh crore opportunity projected by the Indian Navy.

The Global ship repair industry is expected to grow more than 3 times from the current USD 12 billion to reach 40 billion dollars by 2028. Adding to that, the revenue contribution of MDSL’s ship repair division has increased more than 4 times from FY19 with a strong focus on reviving its ship repair operations which will result in augmentation of its revenues and profitability.

Why invest in MDSL?

The key investment arguments summarized would be:

Large order book from the Indian Navy of INR 46000 crores to be executed over the next 5-7 years. It is also in contention for another INR 2.1 lakh crores of orders being given out by the Ministry of Defense over the next decade

MDSL has completed the modernization project of INR 900 cr in which the Government of India GoI funded INR 800 cr, this project will enable integrated modular construction going ahead, thereby substantially reducing the build period for upcoming projects. Due to this project, the capacity of outfitting warships increased by 25% and submarine capacity has increased by almost 83%. Additional Infrastructure will provide a competitive edge in gaining new projects, therefore creating additional revenue.

The strategic location of the port on the global maritime route connecting Europe, West Asia, and the South Pacific Rim

B. Key Historical Financials

C. What is my view on company valuation?

The Company did an IPO in September 2020 and was well-received with over 156 times oversubscription. It gave listing gains of ~20% and has generally stayed above its offer price in its brief trading history.

It is currently trading at a P/E TTM ratio of ~8x. The business is stable with a strong order book from the Indian Navy and defense spending is likely to go up, the Company will see growth in the medium term. Further expansion of the client list can help the Company’s business prospects and de-risk it from its over-dependence on the Indian Navy. Cochin Shipyard is a competitor and currently trades at a P/E TTM ratio of 7x. Stock looks interesting in long term and should be evaluated further by investors along with Cochin Shipyard.

D. What are the risks to the investment analysis?

Risks to the analysis are:

Indian Navy uses 4 shipbuilding dockyards, namely Hindustan Shipyard, Garden Reach Shipbuilders, and Cochin Shipyard. In case any of these shipbuilders enhances its capacity and technological tie-ups, the pipeline for MDSL might get impacted adversely, thereby affecting the long-term growth of the Company

In the past, defense projects have had significant delays of 4-5 years in delivery. In case, there is a change in the strategic imperative for the Navy, this sort of delay in future projects might impact business for MDSL and can also lead to liquidated damages.

Risk of Project Termination: The MoD contracts including the submarine refit contracts are subject to the satisfaction of certain milestones and are subject to termination. Its inability to fund such contracts at the time of inception or any termination of any of its contracts with the MoD could hurt its financial condition and results of operations.

[End of Part 4]

Part 5: Cochin Shipyard Ltd (Budget Tailwind)

Company Name – Cochin Shipyard Ltd (Cochin Shipyard)

Current Share Price – INR 314 (June 23, 2022)

Market Cap – INR 4,136 cr

A. What is interesting about the stock?

Have you watched Rustom (starring Akshay Kumar, and Ileana D’Cruz)? What was the core reason for the plot? Indian Navy wanted to buy an aircraft carrier to augment its fighting capacity – but on inspection, it was found by Rustom that the carrier’s hull was corroded, and it would have to be repaired and modified before the carrier could be transferred to India. Indian Navy has been looking for an aircraft carrier for the following reasons:

The first is the support of a conventional war against Pakistan, which would involve strikes against Pakistan's naval assets and land bases.

Second, the carriers make the Indian Navy the preeminent force in the Indian Ocean, better able to command the area than any foreign competitor.

The third prong involves geopolitical competition with China.

So, who is designing and building the first indigenous aircraft carrier, INS Vikrant, for India – Cochin Shipyard. INS Vikrant is scheduled to be commissioned into service in July/August 2022.

Cochin Shipyard Ltd was incorporated in 1972 as a Government of India company, with the first phase of facilities coming online in 1982. The company has Miniratna status.

Cochin Shipyard is one of the leaders in the Indian Shipbuilding Industry. It can build ships of 1.1 lakh Deadweight Tonnage of DWT while it can repair ships of 1.25 lakh DWT. The Government of India owns 73% of the company.

As of March 2021, Cochin Shipyard has built and delivered:

16 Large Vessels

35 Offshore Support Vessels

83 Small & Medium Vessels

20 Defense Vessels

Cochin Shipyard has also exported over 47 vessels to clients from Norway, Netherlands, Cyprus, USA, Germany, Denmark/ Bahamas, Saudi Arabia, and UAE.

Its domestic clients include the Indian Navy, the Indian Coast Guard, the Shipping Corporation of India, Lakshadweep Government, various Port Trusts, Inland Waterways Authority of India (IWAI), A&N Administration, Directorate General of Lighthouses and Lightships (DGLL), and Jindal Steel Works (JSW) group.

The Company has a total of 3 shipyard facilities in Kochi, Kolkata, and Malpe. It also has 4 ship repair facilities in Kochi, Mumbai, Kolkata, and Port Blair.

The major offerings of the company are:

A. Shipbuilding:

B. Ship Repair:

Maintenance and repairs of Aircraft Carriers and other Defense Vessels

Repairs and maintenance of Tankers, Bulk Carriers, and all kinds of Commercial and Specialized vessels

Oil Rig Upgradation, Repair Projects, and Conversions

Shipbuilding contributed to ~80% of revenue in FY22 with the remaining coming from ship repair. Company had a shipbuilding order book of around INR 11,260 cr (~3.5x of FY22 revenue) as of March 31, 2022. Further, Cochin Shipyard has been declared L1 by the Indian Navy for the Next Generation Missile Vessels worth about INR 10,000 cr.

Industry overview

The shipbuilding industry in India is very small with a market share of less than 1% in the global shipbuilding segment. To build up this critical industry in India and to push India to the forefront of the global maritime sector, the Government of India has formed Maritime India Vision (MIV) 2030 which is a long-term plan to develop the maritime sector in India.

This MIV 2030 plan envisions investments of INR 3.5 lakh cr to be made in the sector across ports, shipping, and inland waterways categories.

The defense shipbuilding industry is expected to remain driven by the evolving requirements of the Indian Navy and other government agencies. This is also expected to accelerate in the future, with the push to develop the defense sector in India and become Atmanirbhar for all our defense requirements.

The ship repair industry in India has good potential due to increasing shipping volumes to India and the advantage of skilled labor available at low wages compared to international competitors. The MIV 2030 is also expected to address the issues in this industry and help develop it further in India.

The main competitors of Cochin Shipyards in India are:

Mazagon Dock Shipbuilders

Garden Reach Shipbuilders & Engineers

Key MOATs

Cochin Shipyard is the 1st shipbuilder to design and build an indigenous aircraft carrier in India. This is a big differentiator as it not only highlights the company’s technological and design capabilities but also its project sourcing capabilities.

The company has facilities on the west coast in Kochi, on the east coast in Kolkata, and in Andaman & Nicobar in Port Blair which showcases their capability to service different projects at different locations simultaneously.

B. Key Historical Financials

Company revenue growth has been impacted by COVID-19 and execution challenges. Cochin Shipyard delivered 13% YoY revenue growth in FY22

Management expects flat revenue for FY23 and 16-18% growth in FY24

Ship repair has a higher margin than shipbuilding so the overall margin depends on the business mix. Going forward, the ship repair revenue mix is expected to increase which would lead to higher EBITDA margins

Cash flow convertibility (CFO/EBITDA) has been exceptional in FY22 (similar to HAL) showing the strong cash flow position of the Government of India

Return ratios (ROCE/ROE) have fallen in FY22 to 18%/13% vs 21%/16% in FY21

C. What is my view on company valuation?

Cochin Shipyard did its IPO in August 2017 at an issue price of INR 432 with an oversubscription of ~76x. However, the current market price is at a ~28% discount to the IPO price in the period even when the Nifty50 index has appreciated by ~55%. Company has significantly underperformed the market.

The Company trades at a P/E (TTM) ratio of 7x vs Mazagaon Dock of 8x and Garden Reach of 13x. Additionally, the long-term P/E ratio of the company is 8x.

The stock looks interesting in long term along with Mazagon Docks and should be evaluated further by investors.

D. What are the risks to the investment analysis?

Risks to the analysis are:

The Indian Government is the biggest customer of the company and thus it is vulnerable to political and economic risks that arise from policy and regime changes.

The domestic shipbuilding industry is very small as compared to the global sector and thus a lot of money and effort will be required to bring the sector up to global standards.

The ongoing pandemic and other natural disasters can have a big detrimental impact on the company and the industry in general (especially causing a delay in the capex plans)

The high difficulty of securing project finance for private and commercial shipbuilding in India acts as a big stumbling block for the industry demand and its growth prospects.

[End of Part 5]

Part 6: MTAR Technologies (Precision Engineering)

Company Name – MTAR Technologies Ltd (MTAR)

Current Share Price – INR 1,298 (June 20, 2022)

Market Cap – INR 3,992 cr

A. What is interesting about the stock?

MTAR Technologies Ltd started operations in 1970. Five decades later it seems poised to be one of the largest beneficiaries of India’s journey towards self-reliance in defense and space sector manufacturing. The Ministry of Defense (MoD) started partnering with the private sector in 2001 with permission to have 26% foreign direct investment (FDI) in manufacturing companies. Over the years, various iterations to the Defense Procurement Procedure (DPP) have taken place. In 2020, further revisions were evaluated. The revised draft policy has laid out the markers for the ‘Make in India’ initiative in the defense sector. The policy’s focus is to develop homegrown capability and encourage greater involvement of Indian private companies through reforms. In the space sector, the government approved the creation of the Indian National Space promotion and Authorization Centre (IN-SPACE) in 2020. The institution (IN-SPACE) will guide private companies in the space sector through supportive policies and active engagement with ISRO.

The government wants to promote self-reliance and hence global OEMs would need to either establish manufacturing facilities in India or partner with domestic players. Through its myriad product portfolio, MTAR is well poised to take advantage of the aforementioned developments as it is engaged in precision engineering requirements of the Indian nuclear, defense, and space sectors.

Company Product Offerings:

Clean Energy Sector: Power Units.

Nuclear Sector: Fuel machining head, Bridge and column, Grid plate, Sealing plug, shielding plug, liner tubes and, end fittings, Drive Mechanisms, Top hatch cover beams, and deck plate assembly, CHAS, Ball screws, and water-lubricated bearings.

Space and Defense Sectors: Base shroud assembly and air Frames, Actuator assembly Components, Components for LCA, Various missile parts, Valves, Electro-pneumatic modules, Liquid propulsion engines, Cryogenic engines, Ball screws, and water-lubricated bearings.

Surface treatment, Heat treatment, and Special processes facilities: Various surface treatment activities such as nitriding, anodization, hard chrome plating, nickel plating, induction hardening, electropolishing, pickling, passivation, zinc plating, and painting, among others, and Heat treatment such as gas carbonizing, through their various furnaces.

The company has in the past worked with the Indian Space Research Organization (“ISRO”) and the Defense Research and Development Organization (“DRDO”) to supply specialized products to the Indian space program and the Indian missile program, respectively. Within the defense sector, the Company has supplied complex assemblies to DRDO, such as the base shroud assembly (for Agni missiles), and the assembly of secondary injection thrust vector control (“SITVC”) valves and hydraulic fin tip control (“HFTC”) valves. In addition, MTAR also exports defense components to Rafale and Elbit.

MTAR’s clientele includes ISRO, NPCIL, DRDO, Bloom Energy, Rafale, Elbit, etc. The key product portfolio of the company includes critical assemblies such as Liquid propulsion engines to GSLV Mark III, Base Shroud Assembly & Airframes for Agni programs, Actuators for LCA, power units for fuel cells, Fuel machining head, Bridge & Column, Thimble Package, Drive Mechanisms, etc. to the core of the nuclear reactor.

MTAR operates seven manufacturing facilities, including an export-oriented unit, all of which are located in Hyderabad, Telangana.

Key competitive advantages of the Company are:

Ability to manufacture complex engineering products with a high degree of precision

Elaborate product portfolio that allows the company to cater to multiple requirements of the same customer

High barrier to entry for competitors due to stringent pre-qualification requirements of clients

Company had an order book of ~ INR 650 cr as of March 31, 2022, which is ~2x of FY22 revenue.

B. Key Historical Financials

MTAR’s revenue has grown by 31% in FY22 on a YoY basis. In FY21, nuclear power, space & defense, and clean energy contributed to 14%, 18%, and 64% of the company’s revenues respectively

EBITDA margins have been close to 30%, which reflects the company’s ability to have created a niche for itself

Net debt for the company is negative and hence there are no leverage concerns. The company had used capital raised from the IPO (March 2021) to retire debt

Cash flow convertibility (CFO/EBITDA) has deteriorated in FY21 and FY22 due to higher working capital (receivables and inventory). Cash Flow from Operations was negative in FY22 !!!

In Sept 2021, the company received its single largest order of USD 29.82 Mn (~INR 220 cr) from Bloom Energy for the export of Yuma Hot Boxes and associated components, to be delivered over the four quarters of the calendar year 2022.

C. What is my view on company valuation?

MTAR’s IPO issue price in March 2021 was INR 575 and was subscribed 201 times. Whoa! Currently, the stock is trading at ~2.2x of the issue price. That’s a 120% return over a year! And this is after the stock has fallen ~50% from its peak in December 2021.

Such a rally after the IPO is indicative of the fact that the company is in a unique position to enjoy the growth of clean energy, nuclear, defense and space sectors. But does that justify a P/E (TTM) ratio of c. 66x?

The company must grow at a rapid rate to justify current valuations. But as mentioned earlier, the company has grown at a CAGR of ~26% in the last 5 years. Given the current order book of INR 650 cr of which the Bloom Energy order is to be delivered in 2022, net profit for the company could jump in FY23. However, the cash flow convertibility is very poor and the return (ROCE/ROE) ratios are falling so the valuation seems to be significantly stretched.

D. What are the risks to the investment analysis?

Risks to the analysis are:

60% of the Company’s revenues are from clean energy where Bloom Energy is the key client. In other segments too the customers are primarily NPCIL, ISRO, and DRDO. Hence there is a high dependency on a few clients

Working capital for the company has increased to almost a year. Lack of a reversal to previous levels or worse a further increase could adversely affect operations and financial health of the company

[End of Part 6]

Part 7: Bharat Electronics (Leading India into modern warfare)

Company Name – Bharat Electronics Ltd (BEL)

Current Share Price – INR 235 (June 17, 2022)

Market Cap – INR 57,187 cr

A. What is interesting about the stock?

We are seeing controversy around Agniveers in our country. What is Agniveer?

The Government of India (GOI) approved a recruitment scheme for Indian youth to serve in the three services of the armed forces called Agnipath for a limited period, on June 14, 2022, and the youth selected under this scheme will be known as Agniveers. What is the logic of this scheme?

Modern warfare puts a greater emphasis on superiority in areas such as the air, space, and cyberspace – reducing the importance of the ground force. So, it doesn’t make sense to continue with similar strength of the army especially when a nuclear arsenal is a deterrent for large man-to-man combat. Branches such as the navy, air force, and missile units can now play a bigger role in the event of conflict by fighting enemy forces beyond borders. Electronics have become of paramount importance in modern warfare.

With the supply chains disrupted due to Covid-19 and the possibility of geopolitical pressures due to India’s external affairs policies, the aim is to decrease import dependence. The Government of India has formulated the Defense Production and Export Promotion Policy (DPEPP), 2020, which provides thrust to India’s defense production capabilities and exports with a measurable target for defense manufacturing. This Policy aims toward an annual turnover of INR 1,75,000 cr in local defense manufacturing by 2025, which implies a 15% CAGR over FY20-FY25. The policy is looking to double the domestic procurement to INR 140,000 cr by FY25, from INR 70,000 cr in FY20.

GOI is also pushing to develop the domestic defense eco-system through initiatives such as ‘Make in India’ and ‘Atamanirbhar Bharat’ programs presenting opportunities for domestic suppliers. Government has put a ban on the import of ~300 defense equipment and items to boost indigenization.

Bharat Electronics Ltd, a Navratna defense public sector undertaking (DPSU), was established in 1954 under the Ministry of Defense, to cater to the electronic equipment requirements of the defense sector. The Company has ~55% market share in the defense electronics sector. GOI remains BEL's largest shareholder with a current shareholding of 51%. BEL has been conferred the Navratna PSU status in June 2007.

BEL is the dominant supplier of radar, communication, and electronic warfare equipment to the Indian armed forces. The company has nine manufacturing units across India and two research units. The Bangalore and the Ghaziabad units are BEL's two major units, with the former contributing the largest share to the company’s total revenue and profits.

The Company caters to all the three arms of defense i.e. Army, Air Force, and Navy. BEL’s product portfolio covers defense and non-defense segments:

Defense Products - Defense Communications Products, Land-based Radars, Naval Systems, Electronic Warfare Systems, Avionics, Electro-Optics, Tanks & Armoured Fighting Vehicle Electronic Systems, Weapon Systems, C4I Systems, Shelters & Masts, Simulators, Batteries, and Components. Revenue from defense products was 88% of total revenue in FY22

Non-defense product portfolio includes e-Governance Systems, Homeland Security, Civilian Radars, Turnkey Projects, and Telecom Broadcast Systems. Its range of products also includes electronic voting machines (EVMs), communication equipment, radar warning receiver, and casings

Major orders executed in FY22 were:

Future Prospects

BEL has a strong order pipeline with an order book of INR 57,570 cr (including ~ USD 270 million export) as of March 31, 2022 (~3.75x of FY22 revenue) providing adequate revenue visibility in the medium term. Company also increased spending on R&D to ~ INR 1,050 cr vs INR 873 cr in FY21. Management expects:

Order inflow to be INR 20,000 cr in FY23, and R&D investment should be around INR 1,000 cr

Revenue growth of ~15-17% in the next couple of years and EBITDA margins of ~20-22%

Why invest in Bharat Electronics Ltd?

Tailwind in the industry – modern warfare needs more electronics; focus on the increase in localization of defense manufacturing

Established player in India’s defense electronics sector with ~55% market share

Robust order book providing revenue visibility and improved cash position of Indian government leading to better payment cycle (lower cash conversion days or working capital)

R&D spend of ~7% of revenue in FY22

B. Key Historical Financials

Revenue growth has been muted from FY20 onwards ranging between 7-9% - showing that Company faces execution challenges despite having a high order book

EBITDA margin has been stable between 21-24% during FY19-22

Cash conversion days are coming down leading to strong cash flow convertibility (CFO/EBITDA) in FY21 and FY22

BEL is debt-free

I expect the CFO/EBITDA to be ~80-85% in the next few years implying a CFO of at least INR 3,000 cr which would be enough to support the current dividend level (~INR 1,000 cr) and capex of ~INR 500-600 cr

Robust return (ROCE/ROE) ratios at 27%/21% in FY22

C. What is my view on company valuation?

BEL share price has increased ~55% in the last 1 year vs negative return in most of the indices.

Company trades at an EV/EBITDA multiple of 16x and P/E (TTM) of 24x vs a five-year P/E (TTM) multiple of 15x. Given that the Company has faced execution challenges and is a PSU but has strong tailwinds, I would be comfortable at a PEG ratio of 1.25x with EPS growth to be ~15% for the next few years implying a P/E ratio of 18-19x.

So, BEL is expensive at the current levels, and investors can evaluate entering at lower levels.

D. What are the risks to the investment analysis?

Risks to the analysis are:

Exposure to government procurement policies and payment cycles

BEL being majority-owned by the Government of India, may not always take decisions that are in favor of minority shareholders

Increasing competitive pressure from the private sector

[End of Part 7]

Disclosure

We have no stock, option, or similar derivative position in any of the companies mentioned since the last 30 days, and shall not initiate any such positions within the next 5 days. We wrote this article ourselves, and it expresses my own opinions. We are not receiving compensation for it (other than from SocInvest). We have no business relationship with any companies whose stocks are mentioned in this article.

We are not SEBI registered advisors. This article is purely for educational purposes and not to be construed as investment advice. Please consult your financial advisor before acting on it.

We have used publicly available information while writing this article.

Comentários